Trading Trending Cryptos using Generative AI Models with TBIG Tokens

What you can do with thematic trading & investing in trending cryptos and stocks

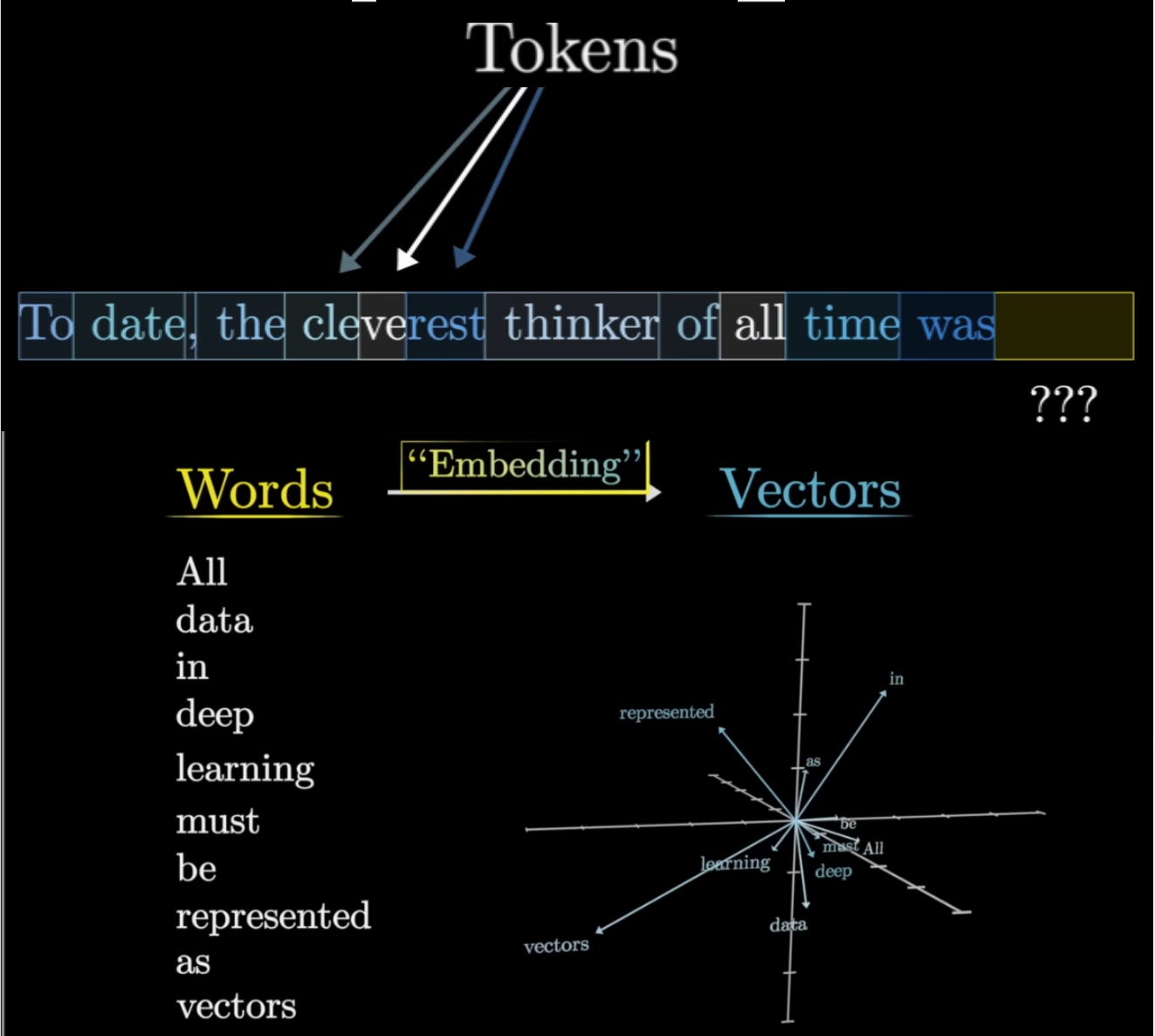

All data in deep learning, the core of today’s language models (SLM/LLM/GPT AI models), must be represented as vectors in a vector space.

One the largest misconceptions the general public has related to language models is that they must be based on human language. This is not the case. A sequence of attributes chopped up from any object from images to biological language modeling using DNA/RNA sequences to data associated to cryptos and stocks, represent a “language” otherwise known as financial language modeling.

At Vectorspace AI X, our team builds datasets and algorithms that sit on top of some of today’s most effective foundational generative AI models including ChatGPT, Anthropic’s Claude AI, Google’s Gemini and others for the purpose of generating thematic investing opportunities in cryptos and stocks.

Thematic investing has proven to be an effective investing strategy. The Thematic Basket Index Global (TBIG) is a token used to generate dynamic thematic baskets based on trending cryptos and stocks.

We employ a mixture of language models which are AI models such as LLMs, SLMs, GPTs along with trading algorithms which constantly trade trending cryptos and stocks. Think of it as a ‘MegaBot’ which uses AI tokens for generative AI trading.

Another way of looking at this is that we use a series of Large Language Models (LLMs) such as ChatGPT, Claude, Gemini and others the way a hedge fund uses ‘expert networks’. TBIG tokens are for prompt and context engineering for LLMs/GPTs while VAIX tokens are used for datasets all within a marketplace designed for generating thematic baskets of trending crypto and stocks.

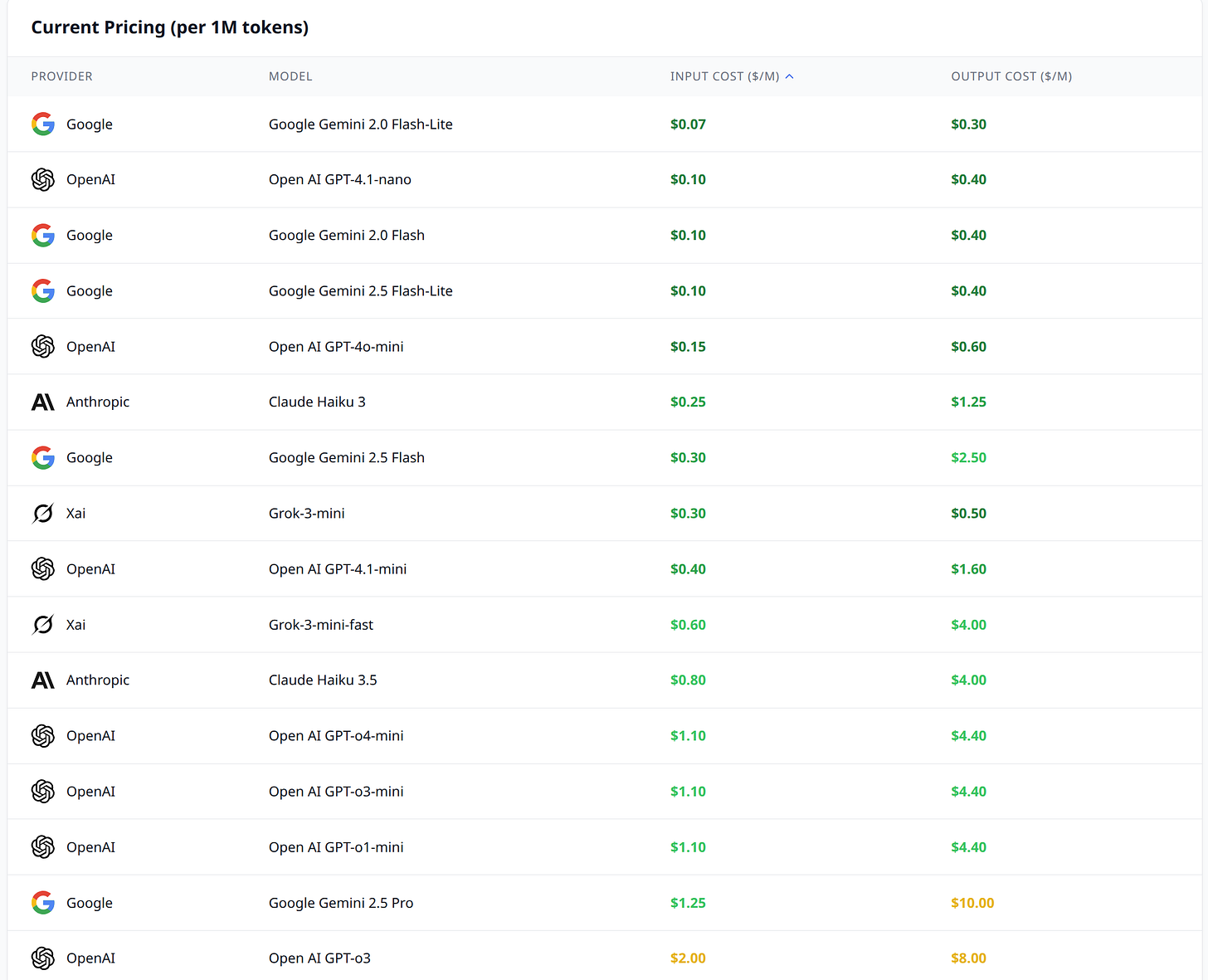

We’ve developed a set of algorithms and applications that sit on top of foundational AI models. One of these is a pricing algorithm that combines AI model token prices and is part of the overall pricing structure which determines a fair market price for TBIG.

Another algorithm is for determining the inverted price of TBIGS (the short side basket of TBIG). TBIGS is the inverted short thematic basket that goes up in price if TBIG (long) goes down in price, similar to an inverse ETF.

We’ll be introducing new feature sets to trade trending cryptos and stocks including pre-built prompts such as:

“Generate a basket of trending cryptos sorted using the Moving Average/Convergence Divergence (MACD) indicator and execute the trade using $100 in capital.”

“Give me a buy, sell or hold rating on each trending cryptos in the thematic basket.”

“You are a market research analyst. Provide a short research report on each trending crypto in the thematic basket.”

“Generate a basket of cryptos based on this basket which might trend up 1 week from now.”

“What kinds of trends are driving the prices of each crypto in the basket?”

“Provide a positive or negative sentiment score for each trending crypto.”

“What would my returns be if I invested $1,000 in each crypto before they started trending?”

Additional features in the pipeline include generating a custom basket and trading it with 1 click based API exchange integrations.

The science, engineering, technology and strategy is based on the IP/asset innvovation pipeline of Vector Space Biosciences where high-value assets are tokenized in partnership with Vectorspace AI X.

More on how tokens and vectors are used in today's AI models:

TBIG and TBIGS represent exchange-traded tokenized assets otherwise known as RWAs. Each has a specifically optimized Market Making (MM) system which maintains fair market price levels during trading along with an auto-reward system. Receive auto-rewards today by joining our Telegram for more information:

A detailed view into our current high-value RWA, VectorCube VCUB:

More information on VectorCube can be found here.